Data Speaks: Special Edition on China-U.S. Ties -- The Most Important Bilateral Relationship in the World

How and Why?

Subscribe for free |View in your browser |Tweet@TIANDongdong

HOWDY! This is Tian in Beijing. Hope you had a great weekend! It’s Monday, and today marks the inauguration of Donald Trump as the 47th President of the United States.

Following his election victory, Trump said in a press conference at Mar-a-Lago that China and the United States could work together to solve all of the problems of the world.

To shed light on this pivotal relationship, your Watchers have pulled together key economic data that paints a vivid picture of why this bilateral partnership matters so much. Let’s dive in!

BALLAST STONES

The United States and China are two of the five permanent members of the United Nations Security Council, underscoring their significant role in global affairs.

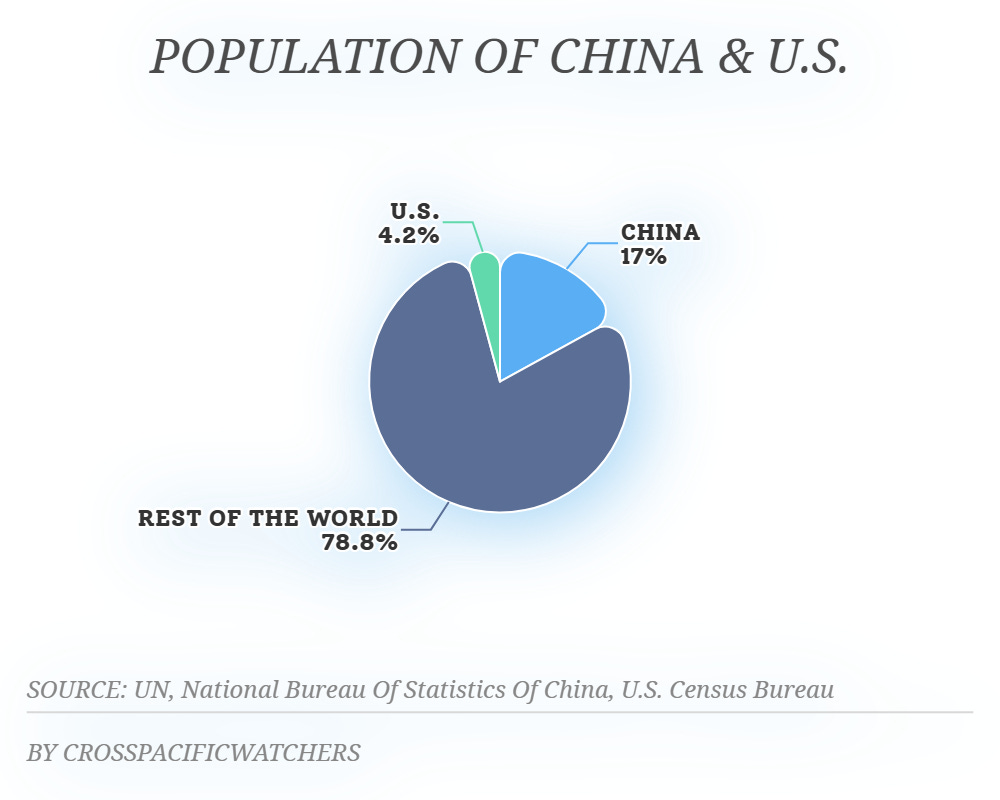

In 2024, the United States remained the world’s largest economy, with a GDP of approximately 29 trillion U.S. dollars. According to the U.S. Census Bureau, U.S. population reached 340.1 million as of July 1, 2024, accounting for about 4.2% of the global population.

Source: Statista, a global data and business intelligence platform

China, the second-largest economy, had a GDP of 134,908.4 billion yuan in 2024, a 5.0 percent increase over the previous year at constant prices. By the end of 2024, China's population reached 1,408.28 million, or about 17% of the world’s total.

These figures emphasize the global economic and demographic influence of both nations, reinforcing their pivotal roles on the world stage.

ROBUST ECONOMIC COOPERATION: A SNAPSHOT

From 1979 to 2023, trade between China and the United States grew over 200-fold, with the total volume of two-way investment exceeding 260 billion dollars. This remarkable growth underscores the deep economic ties forged between the two nations over decades.

In 2024, despite strains in their bilateral relationship, trade continued to thrive. During the first 11 months, the trade value between the two countries reached about 617.73 billion dollars, reflecting a 4.2 percent year-on-year increase.

China remains a key market for American exports. According to an April report by the U.S.-China Business Council, China ranked as the United States' third-largest goods export market in 2023 and the sixth-largest services export market in 2022. These exports supported over 930,000 American jobs in 2022.

American businesses also see China as a critical part of their global operations. More than 70,000 American companies have established businesses in the country. The Chinese market generates two-thirds of Qualcomm’s global revenue and one-fourth of Intel’s.

About 80 percent of Apple’s 200 major suppliers manufacture in China. Furthermore, 11 foreign-controlled or wholly-owned securities companies, including J.P. Morgan Chase, are now operating in China.

Conversely, Chinese investment in the United States has had a positive impact on local economies. Chinese members of the China General Chamber of Commerce USA have invested over 144 billion dollars in the United States, creating more than 230,000 jobs directly.

These numbers reflect the mutual benefits of China-U.S. economic ties. Despite challenges, the interdependence of the two economies remains a cornerstone of their bilateral relationship.

RESILIENT MOMENTUM OF PEOPLE-TO-PEOPLE EXCHANGES

Since the 1970s, when China and the United States reopened their doors to each other, educational exchanges have played a key role in fostering mutual understanding. Over the years, around 2.4 million Chinese students have traveled to the United States for their studies.

In 2023, China announced in San Francisco an initiative to invite 50,000 young Americans to China for exchange and study programs over a five-year period. In 2024, under the initiative, more than 16,000 young people from the United States came to China for exchange and study.

Currently, about 300,000 Chinese students are pursuing further education in the United States. Travel between the two countries is becoming more convenient, with direct flights increasing to 100 per week and the U.S. Department of State downgrading its travel advisory for China to Level 2.

Additionally, applying for a visa to China is easier and takes less time. In particular, American students who are part of the YES (Young Envoys Scholarship) program can get a five-year F visa with multiple entries for free.

TARIFFS BACKFIRE

Given the strong interconnectedness between the U.S. and Chinese economies, imposing tariffs on Chinese products and other restrictive trade and investment measures is likely to backfire, driving up inflation and hindering innovation, as history and research have shown.

A joint U.S. study released in 2023 assessed the impact of Section 301 tariffs, which have been imposed on U.S. imports of apparel, footwear, travel goods, and furniture from China since 2018. For footwear alone, these tariffs imposed an annual direct cost on importers of at least 250 million dollars, which escalated each year to exceed 450 million dollars in 2022.

The study found that the increased costs and prices resulting from these tariffs were ultimately passed on to American companies and families.

Additionally, the U.S. International Trade Commission reported that the Section 301 tariffs raised the price of semiconductors in the United States by 4.1 percent from 2018 to 2021.

Efforts to isolate Chinese firms also carry potential costs, according to the Peterson Institute for International Economics, including stifling innovation for the United States and allied businesses, as well as encouraging the circumvention of sanctions.

“The two largest economies in the world combined account for over 40% of global GDP. Currently, the average tariff is 20%. If tariffs were increased by another 60%, it would be unprecedented, and the impact on the world is (would be) obvious,” said Zhang Yuyan, a senior fellow and director of the Institute of World Economics and Politics, Chinese Academy of Social Sciences, during a recent panel focusing on the China-U.S. relationship in Beijing.

“I suspect he will ultimately settle for something less. But whatever the final tariff rate, it is important to stress the flawed logic of this approach — that imposing a steeper penalty on the largest bilateral piece of a multilateral trade deficit with many countries won’t work,” said Stephen Roach, former chief economist and Asia chair at Morgan Stanley, in a recent article published on his Subtack Conflict.

“As long as domestic saving remains suppressed by outsize federal budget deficits, as the likely fiscal policy of Trump 2.0 suggests, a China-centric ‘remedy’ will simply lead to another round of trade diversion that will further penalize U.S. producers and consumers,”said Roach.

Note: Data in this newsletter is cited from public releases by Population Division of the United Nations Department of Economic and Social Affairs, Embassy of the People's Republic of China in the United States, Statista, National Bureau of Statistics of China, United States Census Bureau, and China’s Xinhua News Agency, among others.

For further questions, feel free to contact your Watchers. Enjoy reading!

About the Newsletter:

Ran by TIAN Dongdong, this newsletter features daily and trustworthy content on China's economy. Having worked in Brussels, London, Cairo, and Tripoli for Chinese media as correspondent for several years, TIAN is now based in Beijing.